Dear Clients and Friends,

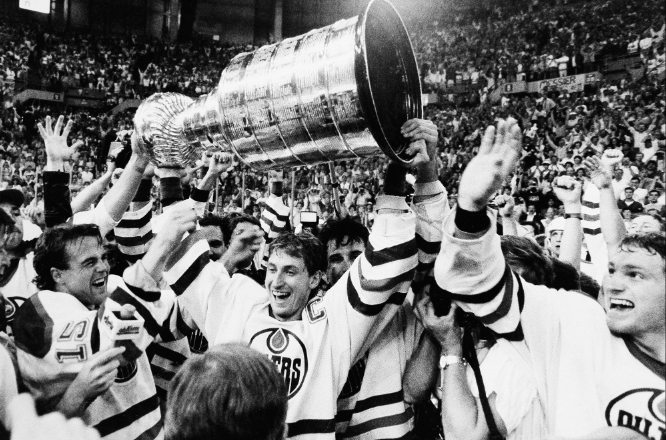

Wayne Gretzky once scored 92 goals in an 80-game season, so it is safe to assume that Gretzky was a master at his craft. Today his quote about “skating to where puck is going to be”, (while being ubiquitous in business power point presentations), is a powerful reminder of what the investor has to do in order to make money through multiple market cycles. The future, or the future placement of the puck, is all that one can look towards to gain insight into what needs to be done today. In this short piece I would like to explain a few principles that investors use to predict where things might be headed.

What goes up must come down. The law of gravity seems to work on both earthly objects and on asset values. Very few assets can go in one direction for an extended period of time, we see this with houses, stocks, and even bonds over time. This simple action is known as, ‘reversion to the mean’, and all investors need to be aware that regardless of the reason, reversion towards the mean is very likely with stock prices. In fact, there are whole slices of financial markets where ‘mean reversion’ is something akin to a trading law rather than just a theory (futures and options markets).

Another way we can look at the future is through the lens of basic fundamentals. Does the company make a lot of money, and are we certain that the business can continue to churn out profitable results into the future? Does the business have the right amount of debt? The fundamentals matter most when the company is having difficulty with its business. A fundamentally sound company with a predictable business model is a great place to park money when perception turns from good to bad. Over time the perception will change and the business will emerge stronger and more valuable than before the crises.

With fundamentals comes valuation, which is nothing more than asking how much one is willing to pay for the fundamentals they are buying. If someone calls me today to buy a company that makes $100 a year, what would I be willing to give to secure that cash flow? The market puts a valuation on every future cash flow, some valuations are high while others are low. When you buy a stable business with a predictable cash flow, you are in essence owning an interest in that future cash flow for perpetuity. The longer you own it the greater the return, so knowing the future is a function of how much you are willing to pay to buy that future income stream. The less you pay the more shots on goal you will have.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All investing involves risks including loss of principal. No strategy assures success or protects against losses.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.