Dear Clients and Friends,

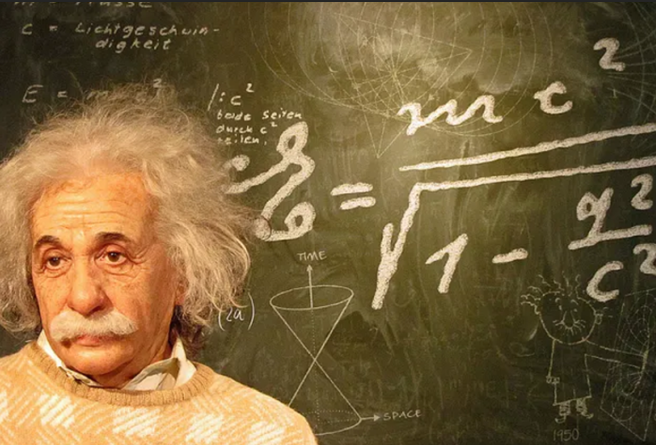

One of the greatest minds in the history of mankind, Albert Einstein, postulated that time is not a constant; rather, time is a variable that is dependent upon speed and gravity. This view of time forever changed physics and in turn modern society, as a multitude of advances for mankind was spawned from the foundation of the Theory of Relativity. So why should an investor care about the theory of relativity and the implications this has for our collective investments, you might ask? The relationship investors have with both money and time is one of the most important subjects of financial planning, but rarely is it discussed on philosophical terms. The investor must strive to place their time and their money in proper context, and thereby achieve their goals.

The investment world today seems fixated on short term price movements and short-term performance. Perhaps this is simply a fundamental part of the human condition, and as such needs no explanation. It may also be partly due to the fact that we have multiple avenues of gathering information and those streams of information have emphasized the short term over the long term. The short term is real, it is instant and decisive. Longer term is cloudier and more intangible. Often, investors believe that if they are able to ‘keep up’ with the short-term movements they will see patterns and learn from the price movements. However, the randomness of short-term price movements is anything but predictable and easy to decipher. Maybe that is why Ben Graham once commented, “In the short run the market is like a voting machine… in the long run the market is like a weighing machine…”.

Warren Buffett once quipped, “Time is the friend of the wonderful company, the enemy of the mediocre”. The longer you have to compound wealth the greater the effect of compounding, and Einstein knew this when he stated, “The power of compound interest is the most powerful force in the universe” (this was coming from the guy who gave us E=MC2). Time and compounding can do wonders for wealth. Yet, when it comes to investments, focusing on the short-term movements of prices creates negative value for both time and money. It is often a waste of time, and it often creates bad reactive behavior.

As we age our money and our time should take on greater import in our psyche. We should have more money and less time, but what we do with each one of these assets is not as rational as one might expect. Many investors feel that the greater the amount of time they spend in front of a financial news channel will directly affect the performance of their investments. This is simply not the case, and even if it were, is this a good trade off? If you could add 1% to your performance, but you had to give up 3 days of freedom, would you do it? Time has value, just like investments, so the asset of time has to be guarded as closely as the investment one seeks to manage. We all know that investments are volatile, but as Einstein showed time is also volatile, so make the best of both. Investors should treat time as a precious asset, and allow it to work its magic all while capitalizing on the wonder of life without fear of investment volatility.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All investing involves risks including loss of principal. No strategy assures success or protects against losses.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.