Dear Clients and Friends,

The year was 1999, the setting was an annual meeting in Nebraska, and one of the greatest investors in the history of our market made his way to the podium to answer questions from his investors. The last several years had been tough years for his investments, and this year he would end up being down 21%, while the tech heavy Nasdaq was up 70%. He was forced to defend this indefensible record during the meeting. His rebuttal was simple- he didn’t have to bet on technology to make money over time in the markets, and over short time frames he was willing to trade an uncertain big payoff for a smaller certain payoff. Many in the crowd left dissatisfied with the answer, how could the greatest of investors miss the obvious (“perfect”) investment opportunities that technology offered. The investor was Warren Buffett, and the time was the late innings of the tech bubble – a bubble that would burst in slow motion over the next 3 years. I think we know how this episode ended, by 2003 the Nasdaq was down over 73%, and Berkshire had climbed 30%, so Warren was standing tall despite the massive underperformance of prior years. *

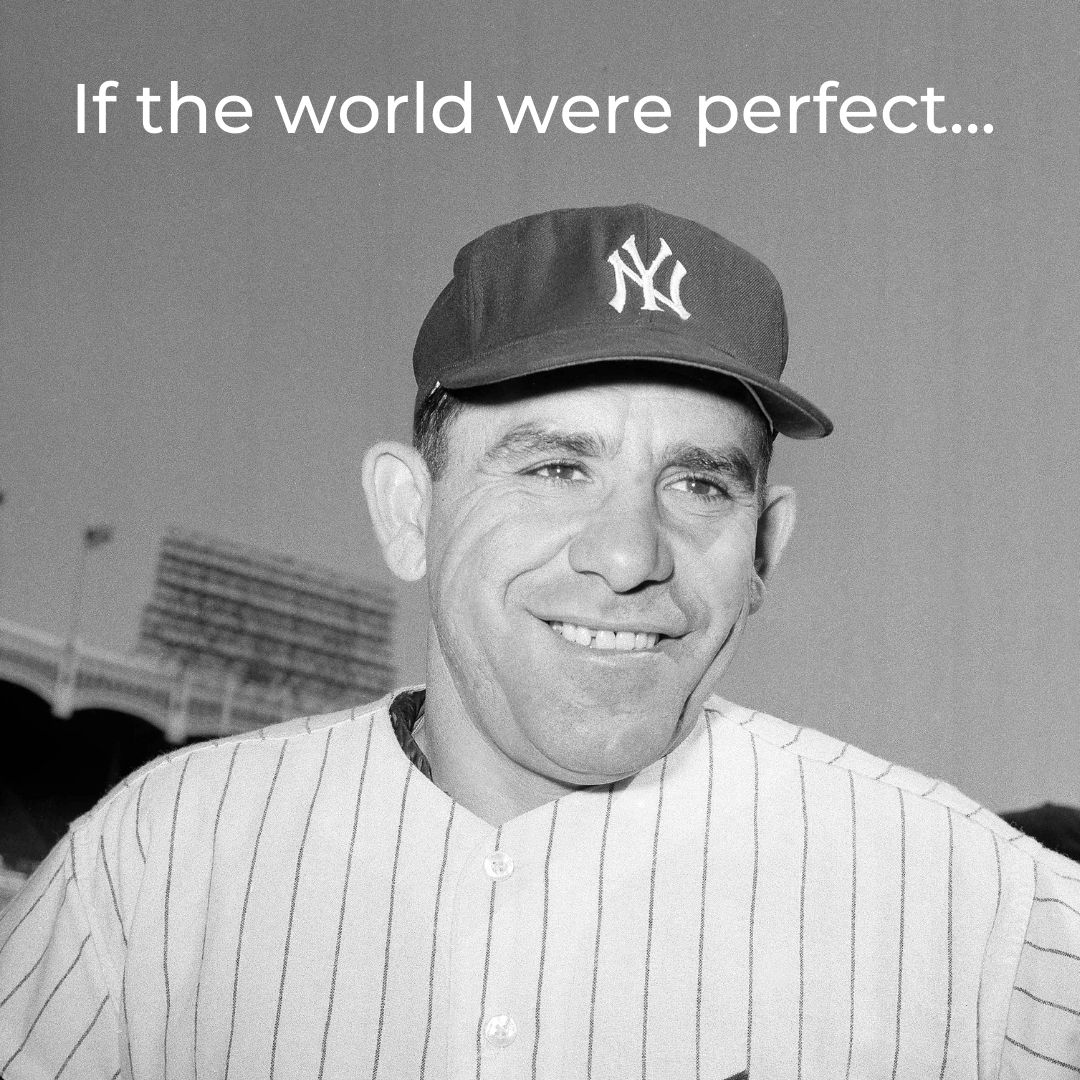

The goal for all investors is to make as much money as possible given a tolerable level of risk. The key metric is risk; if the risk is not acceptable then the investor must pass on the investment regardless of the potential payoff. As Warren Buffett has said, “It’s insane to risk something you have and need for something you don’t really need.” This brings us to the “Perfect World” as described by Yogi Berr, as a non-existent entity. Only in our minds do perfect worlds exist, and the same is true for investors as they analyze ‘perfect’ investments. There are no perfect investments, only investments that adequately reward those for their given level of risk. Sometimes the rewards are elusive, like those experienced by Buffett and his investors in the late 90s. Had you been investing with Buffett you would have fallen woefully short of the market’s performance, and this would have been troubling or for some maddening. All those who questioned Buffett including the highly regarded Barons Magazine with their December 1999 headline, “What’s Wrong, Warren?”, were ultimately proven wrong.

So, what does this have to do with today’s market, you might ask. I have written in the past that when the market becomes concentrated into a handful of successful names, the market creates risk out of whole cloth. This can be seen in the history of our market, “The Nifty Fifty” of the 60s, “the Dot.Com” bubble of the 90s, and the “Housing bubble” of 2008, the only thing ‘safe’ about these concentrations of risk was the illusion that they were ‘perfect’ investments. Today, we have something similar, where the returns of the last year were driven mainly by 7 stocks- sometimes called, “The Magnificent Seven”. These 7 stocks are wonderful companies, and the illusion of perfection is the primary motivation for many investors investing in these names.

As history shows, crises are unpredictable and bubbles are not obvious to everyone. When bubbles burst, many times precipitated by a crisis, the lead-up to the disaster appears obvious, but we know this to be revisionary and fallacious. If bubbles were obvious, they wouldn’t exist. And, if perfect investments were obvious, they wouldn’t exist either.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All investing involves risks including loss of principal. No strategy assures success or protects against losses.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.