Dear Clients and Friends,

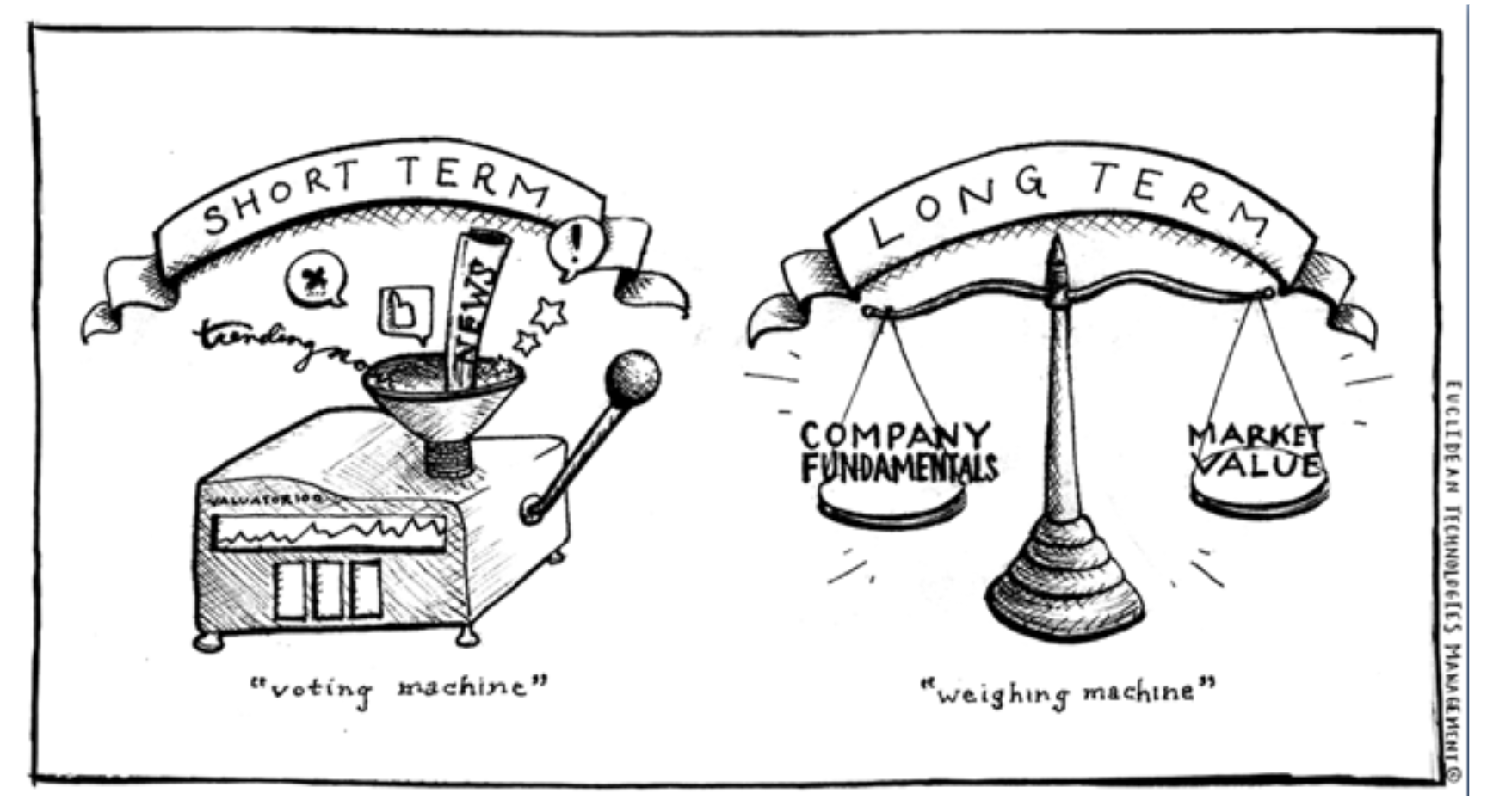

Over the last month we have seen the market go from ebullient optimism (printing all-time highs) to a more skeptical pessimism; resulting in a small but palpable market sell-off last week. This volatility should remind us that in the short-run market sentiment can quickly change. When sentiment changes, it spooks the investor and leads to sell-offs. But the fact remains that markets correct, and these corrections should be expected and, in some cases, welcomed by investors. Now what if I told you that corrections are simply a feature of markets and not a bug – like the tides of the seas or the rhythm of the seasons? As Benjamin Graham once noted, “Over the short-term the market is a voting machine, but over the long run the market is a weighing machine”. So, the voting action of markets creates swings, but the weighing function creates an upward tilt to markets over time. So why is that?

On an election year we may have a heightened sense of voting dynamics, so I will explain it this way: Every day the markets give investors a ballot of investments, and the investment participants vote. Some days the turnout is tremendous… other days it is spartan. If the voters are fearful or cautious you might see the voting turn negative, resulting a sell-off. The same is true for the counter; voters are optimistic and turnout is high and the market races higher. Sentiment can change very fast, and the information we receive on a daily basis tends to mislead us. This is because sentiment changes fast and markets tend to lose steam on both the upside and downside, but the investor only sees the votes, not the actual weight of the market.

If you cracked open the market on any given day, you would notice money flowing in and money flowing out. We see this as the buying and selling of assets (mainly stocks and bonds), largely driven by the money flows. The ‘financial plumbing’ of our markets is just that – an endless stream of money flowing into and out of assets on a daily basis. From time to time the sentiment that controls this flow can rapidly change, causing the ‘pipes’ to back up or slow to a trickle. The perturbations in flow show up as big moves in the markets, but underneath the market we see the pressure build and then release as the flow equilibrates over time. The amount of money flowing through those pipes is what we vote on, but over time the weight and volume of the water grows as more money flows into the system as corporate profits compound.

What investors really want is certainty, and over time the market can create more certainty by acting as a weighing machine. Super-investor Benjamin Graham invested money through the great depression. He had a front-row seat to the meltdown of the 1930’s stock market. It was this ‘trial by fire’ that opened his eyes to irrational short-term movements the ‘voting machine’ can create. But he knew that if his companies made more money over 5-and-10-years, they would eventually provide profits to his investors. He also knew that if he invested his knowledge into young students (he taught a course on investing at Columbia Business School), his students would eventually go on to be good investors. He was right on both counts. His best investment was a small insurance company called Government Employees Insurance Company (later renamed GEICO), that was later sold to one of his brightest students – Mr. Warren Buffet.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All investing involves risks including loss of principal. No strategy assures success or protects against losses.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.